January was a very slow month. The smallcap market, which is the market I primarily trade, was dead. There were very few opportunities that fit within my strategies. I missed some multi-R winners the first week of January. After that, things were just dead…very little would pop up on my Scanz software or on Stockfetcher.

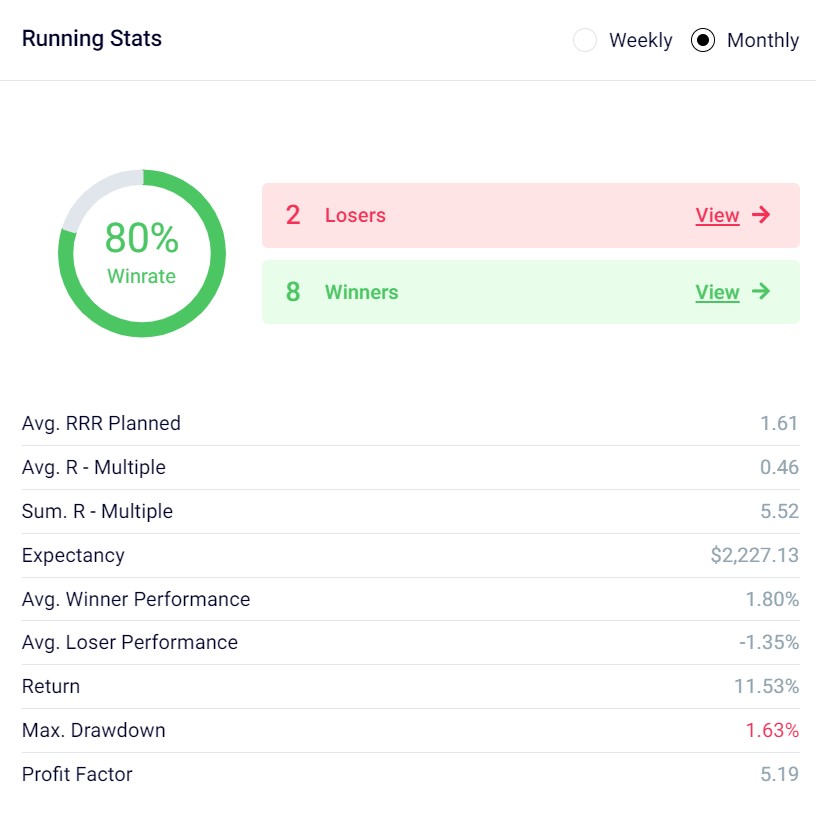

Here’s the stats. I had a high winning trade rate (80%), and only had 10 trades all month. I ended up with +5.5R in profit. While my winning trade rate was high, I didn’t have any multi-R winners. All my winners were +1R or less.

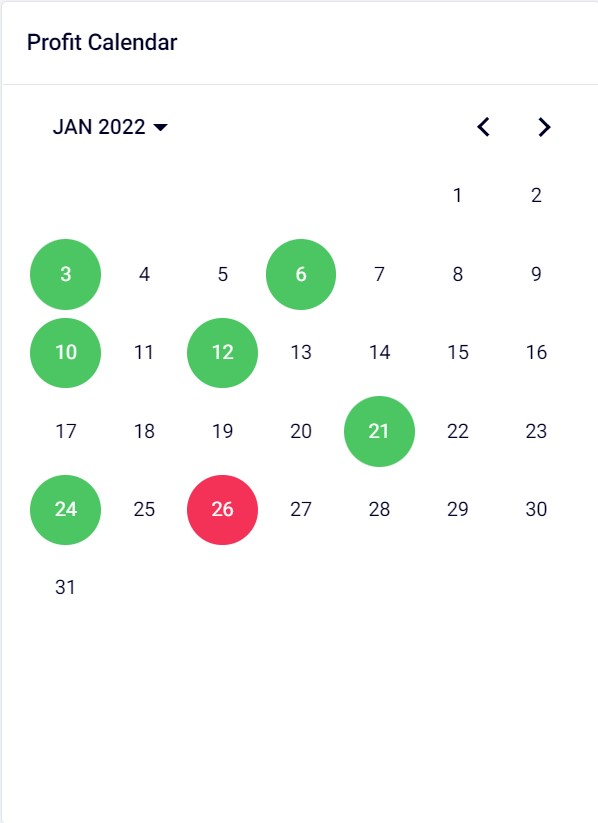

You can see I only traded on 7 days over the month. Six of them were green.

In fact, the smallcap market was so dead that some of my winning trades were from longer term shorts or puts on largecap stocks or funds like TSLA or ARKK.

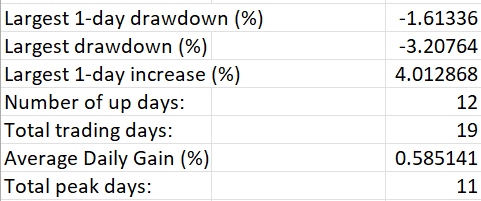

Here’s the stats for my account equity in percentages.

Overall I’m up 11.5% in January, where SPX is down -5.9%. My performance was negatively correlated with the SPX at -0.64 (primarily due to holding longer term large cap stuff…usually I have almost no correlation with SPX in my performance).

Obviously not amazing performance but I did a good job this month of sticking with my known strategies and not experimenting (experimenting too much was responsible for some of my past drawdowns). I’ll continue to be patient. If things continue like this for several months, then I’ll look into developing more strategies.