In 2011, while browsing Yahoo Finance, I was served an ad for Jammin’ Java.

However, this ad wasn’t for their coffee. It was for their stock.

Jammin’ Java was company trading on the Over The Counter Bulletin Board (OTCBB) under the ticker symbol JAMN. The company sold Marley Coffee … yes, a brand of coffee with Bob Marley’s name attached to it.

The internet was flooded with ads for JAMN. But the ads were focused on the stock, not the coffee. Now, there were some videos with Rohan Marley (Bob’s son) that seemed to be focused on the coffee, but even with those videos, they made it a point to show the ticker symbol for the company.

Why would a company that wants to sell coffee advertise its stock?

Because they wanted to hype the stock up so they could sell it at a high price, and let insiders get rich while leaving others holding the bag.

It was a classic OTC pump and dump campaign. But, rather than sending out hard mailers across the country to people’s mailboxes as had been previously done with other pump & dumps, the stock ads were primarily done on the internet.

The campaign was very successful. In early 2011, JAMN went from trading around 50K shares per day at a price of around 50 cents, to over 1 million shares per day. The stock eventually went parabolic, hitting a high of $6.35. And, like every other pump and dump, it would collapse and lose all of its gains.

JAMN now trades for .001 cents.

Before the SEC cracked down on OTC pump and dumps, they were common. I’ve even written about them in the past in their connection with the nutrition industry. One factor in common with all of them is they involved advertising the stock in some fashion. For JAMN, it was through internet ads. For many others, it was often through pamphlets or newsletters you’d get in the mail like these ones for MSEH:

Or this one for NXTH (which still trades for .005/share). This one even included Shaquille O’Neal in the pump.

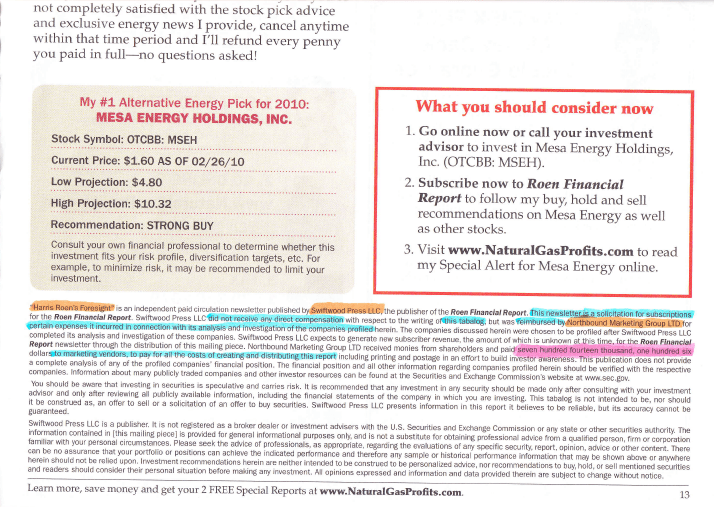

You’ll note that all of these focus more on the stock rather than the company and its product. And that’s because the intent is to get you to buy the stock so that the people behind the paid pump could dump their shares (often which they had obtained for no cost at all) on you. The fine print would disclose that these were paid stock promotions, like this one for MSEH:

“Swiftwood Press, LLC…was reimbursed by Northbound Marketing Group LTD for certain expenses it incurred in connection with its analysis and investigation of the companies profiled herein….Northbound Marketing Group LTD received monies from shareholders and paid seven hundred fourteen thousand, one hundred six dollars to marketing vendors, to pay for all the costs of creating and distributing this report.”

But people usually don’t read the fine print.

Crypto: The New Paid Pump

You don’t see as many paid OTC stock promotions since the SEC has cracked down on a lot of them. But that hasn’t stopped paid promotions in general. They’ve just found a new home: cryptocurrency.

This was on the side of a London bus: an advertisement to buy Bitcoin.

The ads also appeared in the London Underground, and the ads eventually got banned. This also isn’t the first ad to get banned in the UK. Here’s another one encouraging investment in Bitcoin.

Full-page ads to get people to buy Bitcoin also appeared in Hong Kong tabloids. I wish I had screen captured them at the time, but I’ve been served Facebook ads in the past on Bitcoin.

And it’s not just ads for Bitcoin. It’s also ads for other crypto, like this ad with James Altucher.

Legit Companies Don’t Advertise Their Stock

Whenever you see paid ads promoting an investment, that’s a major red flag. The people promoting the investment aren’t looking to help you. They just want you to buy at a higher price. They’re playing the greater fool game, and they’re hoping you’re the greater fool.

They’re playing the greater fool game, and they’re hoping you’re the greater fool

Legit companies don’t advertise their stock. When I go to Costco’s website, I don’t get advertisements to invest in Costco. When I see ads for Target on the internet, those ads don’t tell me to invest in Target stock.

Why? They don’t need to. They have real products to sell. They make money through their business operations…not by selling stock.

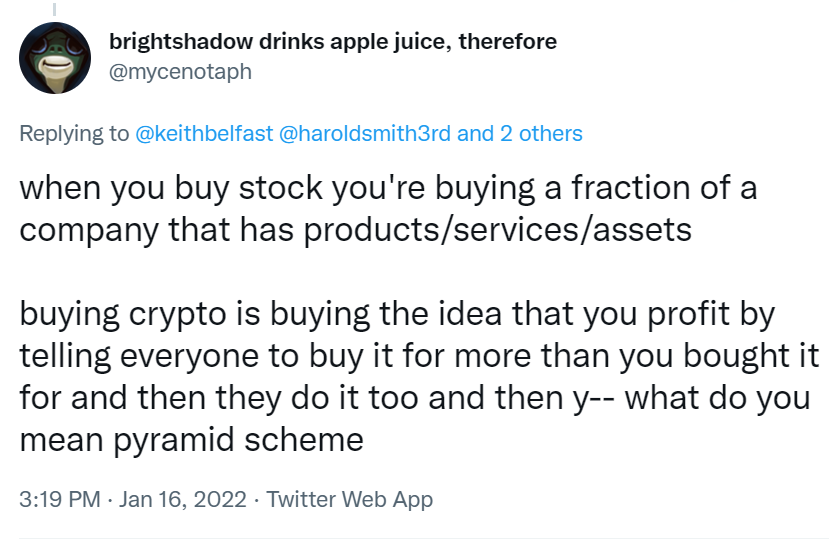

Crypto is nothing like this. There is no underlying company or asset. Its only value is what someone else is willing to pay for it. It’s purely based on belief.

The Similarities Between OTC Pumps and Crypto

Crypto is more similar to the OTC pump and dumps. Here’s a list of the similarities:

1. LITTLE OR NO UNDERLYING BUSINESSES OR ASSETS

Most OTC pump and dumps were shells with no business operations. Of the ones that were business operations, they had little to no revenue and severe losses (JAMN had a cumulative 750K loss through April of 2011). Crypto is the same. There is no underlying business or asset for crypto. There’s literally nothing underneath it other than people’s beliefs.

2. PARABOLIC MOVES

Parabolic moves were common with really successful pumps. JAMN wasn’t the only OTC pump & dump to undergo a parabolic move and crash. Here’s LEXG from 2011.

Similar to the parabolic moves that some OTC pumps like JAMN and LEXG went through, cryptos have undergone parabolic moves and now in the midst of collapses.

3. LITTLE REGULATION

The OTC markets have much less regulation than the NASDAQ or NYSE, making them ideal for scams. This is similar to the crypto world, where there’s very little regulation which makes them a hotbed for scams.

In fact, even scientific papers have shown that the crypto world is rife with pump and dumps.

4. NEGATIVE SUM GAME

OTC pump and dumps are a negative sum game for everyone but the stock manipulators. This means investors as a whole lose money. It has a negative expectancy for investors, meaning the average investor loses money.

Cryptocurrencies are the same. They would be zero sum (the money going in equals the money coming out), but they become a negative sum game when you factor in the money that miners extract from the system.

It’s even worse when you consider the high probability of liquidity problems with Tether and other stablecoins (which act as intermediaries between converting crypto to real $).

This means that, just like the OTC pump & dump, crypto has a negative expectancy … the average investor will lose money on it.

This is very different from the stock market. The average investor who invests in index funds over the long term will make money and have a positive expectancy. It’s a positive sum game because the stock market is tied to economic output. There are real companies with real assets, cash flows, profits, and products underlying the stock market. That’s not true with crypto.

5. EXCITING LANGUAGE

If you look at the paid OTC mailers I showed you earlier, you’ll see a lot of language to excite you. Not only are there mentions of potentially large returns, but you’ll see words and phrases like “Revolution”, “the Saudia Arabia of Natural Gas”, “reshaping our country”, etc. They all promise that you’re getting in on the cusp of something exciting and new. Of course, these claims weren’t even close to reality.

The claims being made about crypto are no different. I’ve seen massive price targets put on crypto (like $250K for Bitcoin). I’ve heard crypto described as “revolutionary”, “disruptive,” “like the beginning of the internet”, “you’re getting in on ground floor”, “the latest technology”, etc. Of course, none of it’s true.

The emperor has no clothes, yet there’s a lot of people getting all excited about how good the emperor’s clothes look.

It’s not revolutionary or disruptive. “Blockchain” on which cryptocurrencies are based is simply technobabble for a type of encrypted decentralized database, and there’s nothing revolutionary about it. It’s not “disruptive” either. The last time I checked, Bitcoin, despite being around for 12 years, is only accepted by less than .01% of U.S. businesses (many of which are likely just crypto-related companies anyway). It’s extremely energy inefficient (currently, the average Bitcoin transaction takes enough energy to power a U.S. household for over 40 days…the same energy that it takes to do 1 million Visa transactions). It’s extremely slow (the Bitcoin network can only do around 7 transactions per second). The massive inefficiencies and energy consumption make them unscalable. The volatility makes cryptocurrencies unusable as currencies or as stores of value. They contribute to massive hardware waste. It’s unsustainable since the massive energy consumption only grows as the network and price go up. It’s also not like the beginning of the internet. From the 12-year period of 1992 to 2004, the internet showed rapid development and expansion to where EVERYONE was using it and it became a major component of everyone’s lives. In the 12 years of Bitcoin and all its crypto children, the only substantial changes have been in the prices, and the massive network energy consumption. I could go on and on, but there’s a massive gap between the supposed promises and language surrounding crypto and the reality. The emperor has no clothes, yet there’s a lot of people getting all excited about how good the emperor’s new clothes look.

6. CELEBRITY INVOLVEMENT

There have been many cases of celebrities getting involved in OTC pump and dumps. I already showed you the example of Shaquille O’Neal’s involvement in the NXTH pump. Tiger Woods, the rapper 50 Cent, and Justin Bieber have also been involved in pump and dump campaigns. And the same is true with crypto, with Floyd Mayweather appearing at a Bitcoin conference and Paris Hilton pumping it as well.

The Main Difference Between OTC Pumps and Crypto

At least OTC pumps come with a disclaimer.

At least OTC pumps come with a disclaimer

Post-Script

I usually don’t care if people want to play greater fool or zero sum games. Hell, I’m a day trader which is a zero sum game at best. But, I’m very real with people when it comes to day trading. I tell them the stats that 80% of day traders lose money and less than 1% are able to predictably and reliably make money over the long run (which means that I’m in that 1%). I tell them it’s zero sum so that for someone to win, someone else has to lose. I usually warn people against getting into it, even though I day trade myself. And I tell them if they’re going to do it, prepare for a long, hard road before you get consistently profitable (if you ever do).

But people aren’t real when it comes to crypto. I don’t think your average Joe who has gotten into it is dishonest. I just think the person gets caught up in the excitement and emotions about it, and is unable to view it objectively. I think many aren’t aware of the risks (particularly the systemic risks), and/or downplay the risks and overestimate the upside if they do know about them (people in general have poor conceptions of risk/reward…look at the people who are willing to risk COVID but not get vaccinated). I think a lot of people also don’t know just how bad the energy consumption is, and if they do know, they have a tendency to greenwash it. I also think people don’t understand why it’s a negative-sum game.

I’ve gradually become more outspoken against crypto…moreso than your run-of-the-mill stock pump & dump simply because crypto costs all of us without giving us any real benefit. Its massive energy and hardware costs, carbon footprint, and enabling of ransomware (the Colonial pipeline ransomware attack was very costly) are serious problems. I’ve got no problem with people that want to speculate, but unfortunately this is an instance where people’s speculation are costing everyone else…not just the speculators.

I’m the type of person that, when I’m a neutral observer, I’ll read arguments from both sides to get a better idea of what’s going on. And every pro-crypto argument I’ve seen fails miserably. And the only pro-arguments I’ve seen for crypto come from people with a vested interest in it. So you need to ask yourself the question: who’s going to be more objective in their assessment of it? Would you believe independent scientists on the impacts of cigarette smoking on lung cancer, or tobacco companies?

I’ll note that I have friends who have invested in crypto in one way or another, so if you read this, this isn’t anything personal against you. But, just like in the fitness industry, I’m a skeptical, evidence-based person and the evidence isn’t in crypto’s favor.

…what has crypto actually done? What effect on society has it had, other than its ability to generate wealth for the wealthy and arbitrarily make a few others rich? What product has come out of crypto that you use? If crypto was to be entirely eradicated tomorrow, what hole would it leave in the average person’s life unless they’d put money into it?

– Ed Zitron, “The Nihilism and Exploitation of the NFT Industry”

Reading List

If you want to read further on crypto, why the major arguments for it fail, scientific sources on its energy consumption, and the problems with stablecoins like Tether, here’s some sources (list updated 02/04/2022):

- David Rosenthal (who wrote the first paper on Proof of Work, as well as being one of the early NVIDIA guys)’s Stanford lecture on cryptocurrency

- The Case Against Crypto (outlines the major problems with it)

- Carol Alexander (a finance professor) blog which outlines the Tether and Bitcoin ponzi structure of the ecosystem

- Why Cryptocurrency is a Giant Fraud (tears down all the major arguments for crypto)

- The intellectual incoherence of cryptoassets

- Bitcoin is a Ponzi (an article by a computer science professor explaining why Bitcoin and other crypto fit every definition of a Ponzi, while stocks/real estate/gold do not)

- How badly is cryptocurrency worsening the chip shortage (a lot…and also shows why higher Bitcoin prices aren’t sustainable)

- Anyone seen Tether’s billions? (Bloomberg investigation on the stablecoin backbone of the crypto ecosystem)

- Blockchain, the amazing solution for almost nothing

- Why crypto has failed its own criteria

- The Tether ponzi scheme

- The Tether Papers (outlines who is acquiring most USDT)

- More evidence that stablecoins lack sufficient reserves, and there’s not enough money in the crypto ecosystem to cover everyone

- Why comparisons between the early internet and blockchain fail

- The conspiracy theory economics of Bitcoin

- Bitcoin Energy Consumption Index

- Bitcoin Boom: What Rising Prices Mean for the Network’s Energy Consumption (peer-reviewed scientific journal article)

- The Alternate Reality Game That Is Crypto

- Cambridge Bitcoin Electricity Consumption Index

- Goldman Sachs Analysis of crypto, with some great graphs showing just how much of bubble it really is

- Why Bitcoin’s Security Model Increases the Risk of a 51% Attack as the Network Grows

- Bitcoin’s Dirty Little Secrets (B of A analysis along with David Gerard’s comments)

- Academic paper showing Bitcoin is used mostly for gambling and also is not decentralized

- Why crypto has more in common with 19th century financial markets than the stock market

- Why Bitcoin will never become the global reserve currency

- Why something can’t be both a currency and risky asset at the same time

- Why Bitcoin won’t democratize money

- The Nihilism and Exploitation of the NFT Industry

- Crypto: The Handwavy Technobabble Nothingburger

- The Internet’s Casino Boats (discusses how crypto exchanges are highly manipulated and rigged since there is no regulation)

- Blockchains don’t solve problems that are interesting to me (shows how crypto doesn’t solve real world problems to make it valuable to most people)

- Cryptocurrencies: A Necessary Scam?

- Blockchain study finds 0% success rate

- The Biggest Crypto Lending Company is a Massive Ponzi Scheme

- An Estimate of the Leverage in the Crypto Ecosystem (it’s at least 17X)

- My Twitter thread on why Bitcoin’s upside is limited

- My Twitter thread on the comparison between Bitcoin and MLM market saturation

- Crypto lending and why you should stay the fuck away from it

- Why Bitcoin is Worse Than a Madoff-Style Ponzi Scheme (author compares it to OTC pump & dumps similar to what I did in this article)

- Why crypto is like a rigged poker game (a Twitter thread by moi)

- Why smart contracts aren’t smart

- Why you can’t cash out pt 1: Why Bitcoin’s ‘price’ is largely fictional

- Why you can’t cash out pt 3: Bitcoin is not a Ponzi scheme! It just works like one

- Cryptocurrency is Garbage. So Is Blockchain (SSRN academic paper)

- NFTs are so dumb

- The Web3 Fraud

- An illustration of just how horribly inefficient Bitcoin is and its hidden costs

- The Encrypted Threat: Bitcoin’s Social Cost and Regulatory Responses

- Your Million-Dollar NFT Can Break Tomorrow If You’re Not Careful

- Why crypto doesn’t bank the unbanked

- A tweet showing just how divisive crypto is within the tech community, indicating it’s not “the future” and there’s no way you’ll ever see mass adoption

- “But for all the hype, there’s scant evidence that digital currencies stand on the threshold of some kind of mainstream breakthrough”

- The advantages of the early internet/early mobile were obvious. The supposed advantages of crypto haven’t been anything obvious beyond “the guy telling me about it wants my money”

- There’s no future in something when a lot of people don’t want it

- The Anatomy of Bitcoin Price Manipulation

- Why Crypto Gaming is Not the Future

- Growing List of Countries with Overstrained Power Grids Due to Bitcoin Miners

- Impossible Finance – The Zero Coupon Perpetual Bond

- Web3 isn’t about technology…it’s about VCs trying to dump tokens on retail as fast as possible

- Crypto, Web3, and The Big Nothing

- Game Developers Aren’t Interested in Crypto or NFTs

- Why the cryptography in crypto isn’t even good cryptography, and why crypto doesn’t solve any problems that haven’t already been solved by better, more efficient, cheaper tech

- The Inevitability of Trusted Third Parties. if: problem + blockchain = problem – blockchain, then: blockchain = 0

- Smart contracts are a bad idea

- When Crypto-Exchanges Go Broke You’ll Lose It All

- Just Rubble from the Crypto Bubble

Bitcoin is not like the early internet.

And this video is probably one of the most thorough educational videos on crypto, NFTs, and Web3 that you’ll find anywhere. It’s over 2 hours long, but has had 2.5 million views as of 1/27/2022.

Crypto-currencies are pyramid schemes designed to enrich the few on the basis of FOMO in the many

– Mark McCaughrean

I have never read a profile of someone who became a billionaire by using crypto to solve any problem other than trading more crypto

– Matt Levine

DISCLOSURE UPDATE 6/17/2021: When I originally posted this, I had no position in any crypto related instruments. However, given the extreme bubble and the high probability of a collapse of the crypto ecosystem due to a variety of factors, I now have some long-dated MSTR puts.

DISCLOSURE UPDATE 11/15/2021: Given the massive systemic risks in the crypto ecosystem, especially in regards to Tether, I recently decided to grab some long-dated BITO and MARA puts.

DISCLOSURE UPDATE 01/14/2022: Given the massive systemic risks in the crypto ecosystem, especially in regards to Tether, as well as the limited long-term upside and large downside risks to crypto, I recently decided to take a small MSTR short position. However, I may not hold it long term as it will depend upon the daily short interest I have to pay on the position.

DISCLOSURE UPDATE 01/23/2022: I have closed out my long-dated MSTR and MARA puts. I continue to hold BITO puts and a small MSTR short position. I may re-enter new short positions on any crypto market bounce.

[…] is also quite common in crypto … for other similarities between crypto and OTC penny stocks, check out my post here) to create the appearance of interest in the stock. People start to buy the stock. But who are they […]